How Insurance Companies Can Leverage AI for Enhanced Risk Assessment and Claim Management

The global insurance industry is facing a digital revolution, with Artificial Intelligence (AI) at the forefront of transforming traditional processes. Insurance companies are under constant pressure to improve risk assessment accuracy, optimize claim management, reduce operational costs, and deliver seamless customer experiences. By leveraging AI, insurance companies can achieve enhanced risk assessment and efficient claim management, ultimately driving growth and profitability.

In this blog, Depex Technologies explores how insurance companies can harness AI to redefine risk assessment and claim management processes, the benefits of adopting AI-driven solutions, and why partnering with Depex Technologies ensures success in your digital transformation journey.

The Role of AI in Insurance

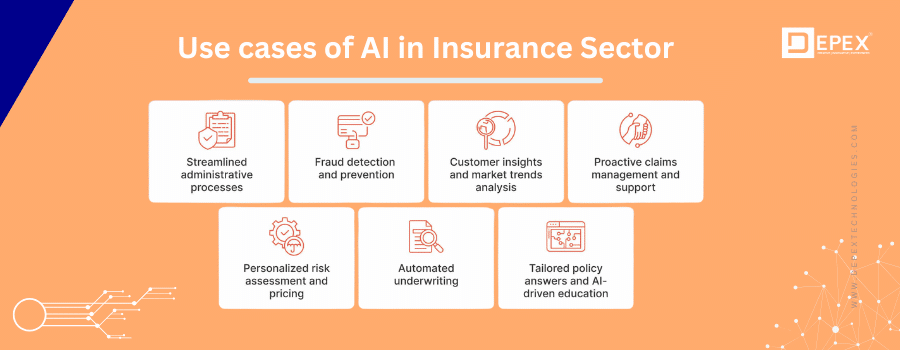

AI fraud detection in insurance is not just a buzzword; it’s reshaping the industry from underwriting to customer service. AI-powered solutions can analyze vast amounts of structured and unstructured data, recognize patterns, predict future risks, and automate repetitive tasks. By integrating AI into their core systems, insurers can make data-driven decisions, personalize offerings, reduce fraud, and streamline claims—ultimately improving both customer satisfaction and bottom-line results.

Why AI is a Game Changer for Insurance Companies

Data-Driven Risk Assessment

Traditional risk assessment relies heavily on manual analysis, historical data, and human judgment, which can lead to subjective evaluations and missed opportunities. AI-driven risk assessment transforms this process by:

- Analyzing Diverse Data Sources: AI can process data from social media, IoT devices, telematics, health records, and even weather forecasts to create a holistic view of risk.

- Advanced Predictive Analytics: Machine learning models identify patterns and anomalies in customer behavior, claim history, and external data, predicting risks with higher accuracy.

- Continuous Learning: Unlike static actuarial models, AI algorithms continuously learn and adapt, refining risk scores as new data emerges.

Streamlined and Automated Claim Management

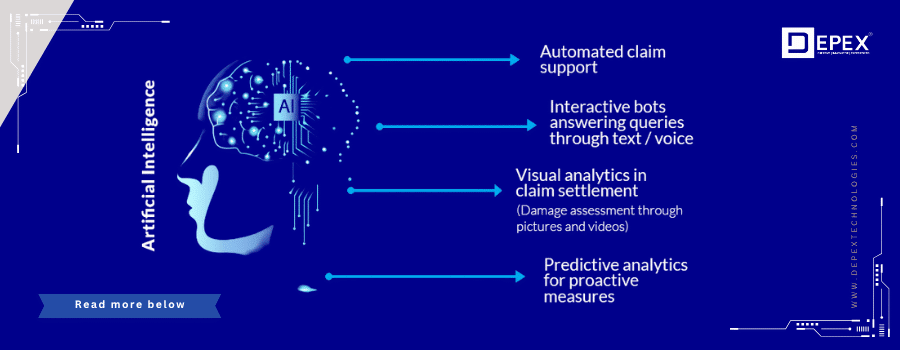

Managing insurance claims can be labor-intensive and prone to errors. AI-powered claim management systems, such as those developed by Depex Technologies, can automate the entire lifecycle, from first notification of loss (FNOL) to settlement:

- Automated Claim Intake: Natural Language Processing (NLP) enables customers to submit claims via chatbots, email, or voice, with the AI extracting relevant information for processing.

- Smart Triage and Routing: AI prioritizes claims based on severity, potential fraud, or policy type, assigning them to the right adjuster or automating low-value approvals.

- Fraud Detection: Machine learning algorithms flag suspicious claims by analyzing behavioral patterns, inconsistencies, and historical fraud data in real-time.

- Faster Settlements: Automated decision engines review policy terms, evaluate supporting documents, and issue approvals or denials within minutes.

Enhanced Customer Experience

AI doesn’t just benefit insurers; it significantly improves the customer journey:

- Personalized Recommendations: AI-driven platforms analyze customer data to suggest tailored insurance products, coverage amounts, and risk mitigation strategies.

- 24/7 Virtual Assistants: Chatbots and virtual agents provide instant support, answer policy queries, update claim statuses, and reduce response times.

- Transparent Processes: Real-time tracking of claims and proactive notifications keep customers informed, building trust and loyalty.

Improved Operational Efficiency

By automating repetitive tasks and optimizing complex workflows, AI in insurance enables companies to:

- Reduce manual errors and process bottlenecks.

- Lower administrative and operational costs.

- Free up human agents to focus on high-value, empathetic customer interactions.

- Scale operations quickly to handle surges in demand.

Key AI Technologies Transforming Insurance

Machine Learning (ML)

ML algorithms underpin many AI advancements in insurance. They enable insurers to:

- Build predictive models for underwriting and claims.

- Score risks more accurately.

- Detect emerging fraud patterns.

- Segment customers for better targeting.

Natural Language Processing (NLP)

NLP powers AI chatbots, document analysis, and voice assistants. It helps:

- Extract data from unstructured documents like claim forms, emails, and medical reports.

- Enable intelligent customer interactions.

- Understand customer sentiment and intent.

Computer Vision

Computer vision technologies analyze images and videos to:

- Assess vehicle or property damage through uploaded photos.

- Automate remote inspections and appraisals.

- Detect fraudulent visual evidence.

Robotic Process Automation (RPA)

RPA bots automate rule-based tasks, such as:

- Data entry and validation.

- Sending notifications and reminders.

- Moving information between systems.

Predictive and Prescriptive Analytics

AI combines predictive and prescriptive analytics to:

- Forecast risks and claims volumes.

- Recommend optimal actions for underwriters, adjusters, and customers.

Real-World Applications of AI in Insurance

Usage-Based Insurance (UBI)

Telematics devices in vehicles collect real-time driving data. AI analyzes this data to:

- Assess risk more accurately.

- Offer personalized premiums based on driving behavior.

- Reward safe drivers with discounts.

Health and Life Insurance

Wearable devices and health apps provide continuous data on customer health. AI:

- Monitors risk factors like heart rate, sleep, and activity.

- Enables dynamic pricing and proactive health interventions.

- Flags unusual claims for further investigation.

Property and Casualty Insurance

AI-powered drones and computer vision:

- Survey disaster-hit areas to estimate property damage.

- Automate claim verification and expedite settlements.

Fraud Prevention

AI identifies subtle indicators of fraud by:

- Comparing new claims against vast databases of historical cases.

- Analyzing digital footprints, geolocation, and transaction histories.

- Scoring claims for fraud risk and alerting investigators.

Customer Service Automation

AI chatbots handle policy inquiries, quote generation, and claim status updates—reducing human workload and improving response times.

How Depex Technologies Delivers AI-Driven Insurance Solutions

Depex Technologies specializes in custom AI software development for the insurance industry. Our solutions empower insurers to unlock the full potential of artificial intelligence for risk assessment and claim management. Here’s how we make a difference:

End-to-End AI Solution Development

From discovery and strategy to development and deployment, we deliver robust AI platforms tailored to your business needs:

- Risk Assessment Engines: Custom ML models that aggregate and analyze all relevant data sources for accurate risk scoring.

- Claim Management Automation: Integrated systems that automate claim intake, processing, and settlement with seamless human-in-the-loop support.

- Fraud Detection Systems: Advanced AI that continuously learns from new fraud patterns, reducing false positives and investigation time.

Secure and Compliant Systems

Insurance data is sensitive. Our solutions are built with end-to-end encryption, role-based access, and compliance with GDPR, HIPAA, and other regulations—ensuring your customers’ data is protected.

Integration with Existing IT Infrastructure

We understand that insurers often have legacy systems. Depex Technologies delivers seamless integration, ensuring new AI modules work flawlessly with your core platforms, CRM, and third-party APIs.

Scalable, Cloud-First Architecture

Our AI solutions are cloud-native, enabling rapid scaling as your data volumes grow. Enjoy high availability, disaster recovery, and cost-effective operations.

Ongoing Support and Evolution

Depex Technologies doesn’t just deliver and leave. We offer continuous monitoring, model retraining, and support—ensuring your AI systems stay accurate and effective as data and business needs evolve.

Implementation Roadmap: AI Adoption for Insurance

- Assessment & Planning

Evaluate current processes, data sources, and readiness for AI adoption. Depex Technologies conducts workshops to align stakeholders and define KPIs. - Data Consolidation & Preparation

Clean, structure, and unify data from internal and external sources. High-quality data fuels powerful AI models. - Custom AI Solution Development

Develop, train, and test machine learning models for risk scoring, claim automation, and fraud detection. Build user-friendly dashboards for decision-makers. - Integration & Automation

Connect AI modules with existing claim, policy, and customer management systems. Automate repetitive tasks using RPA. - Deployment & Training

Deploy the AI solution in your production environment. Train staff and agents on new workflows and tools. - Continuous Improvement

Monitor system performance, collect feedback, and retrain models as needed. Stay ahead of new risks and fraud patterns.

Future Trends: AI’s Evolving Role in Insurance

- Explainable AI: Insurers need to justify decisions to regulators and customers. Explainable AI models enhance transparency and trust.

- AI-Driven Personalization: Hyper-personalized policies, proactive risk alerts, and adaptive pricing are becoming the norm.

- Automated Claims with Blockchain: Combining AI with blockchain enables faster, tamper-proof claims and payments.

- AI for Regulatory Compliance: Automate compliance monitoring and reporting to meet evolving regulations.

Why Choose Depex Technologies for AI Insurance Software Development?

The insurance sector’s future belongs to companies that invest in AI-driven transformation. By leveraging Depex Technologies’ expertise, you gain:

- Deep domain knowledge in insurance technology.

- Proven track record in custom AI solution development.

- Agile, client-focused approach for on-time, on-budget delivery.

- Commitment to data security, privacy, and regulatory compliance.

- Ongoing partnership for your digital journey.

Conclusion: Unlock Insurance Innovation with AI—Partner with Depex Technologies

AI is revolutionizing risk assessment and claim management in the insurance industry. From accurate risk prediction to automated claims and advanced fraud detection, the benefits are transformative for both insurers and their customers.

Depex Technologies stands ready to be your technology partner. Our AI-powered software solutions are custom-built to elevate your insurance operations, reduce risk, and enhance customer experiences. Whether you’re an established insurer or a dynamic insurtech startup, Depex Technologies can help you harness the true power of AI for sustained growth.

Ready to future-proof your insurance business?

Contact Depex Technologies today to discuss your AI-driven risk assessment and claim management software requirements. Let’s build the next generation of intelligent insurance solutions together.